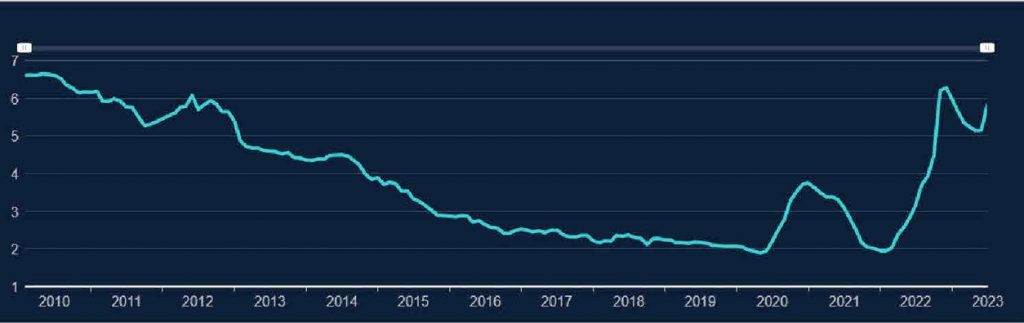

Mortgage rates have been steadily increasing over the last 18 months and will likely stay higher than we have become accustomed to over the last 10 years.

*Source Bank of England Monthly Interest rate of UK financial institutions sterling 2 year (90% LTV) fixed rates.

Whether your current fixed rate is ending in the next 6 months or 24 months you should start to think and plan for higher payments.

What should you be doing?

If the rate is ending in the next 6 months then you should be speaking to your mortgage adviser to start a review of the mortgage rates available from lenders so that a new rate can be secured ready for the current rate ending. This could be a new rate from your current lender or a remortgage to a new lender whoever is going to give the best rate to suit your personal circumstances.

No matter when the current rate ends, if you can, start to make overpayments to your mortgage. Most lenders will allow overpayments of 10% of the outstanding mortgage balance per annum without penalty.

This will get you used to a higher monthly payment ready for the current rate ending but will also reduce the mortgage balance which could mean a lower loan to value when it is time to review rates available. The rates from lender are typical tiered based on the loan to value percentage with rates lower the more equity in the property.

To discuss your mortgage options and rates available get in touch to arrange a review.

Call David or email mortgage@portfs.co.uk

We offer a comprehensive range of first charge regulated mortgage contracts from over 65 lenders across the market but not deals that you can only obtain by going direct to a lender.

Your home may be repossessed if you do not keep up repayments on your mortgage.